The Biggest Mistake I Made in my Twenties

Saving for the Future Today

As I near the 50 years old mark, I look back and see one major mistake I made in saving for retirement. I want to share it with young people so that they do not make the same mistake I did. The mistake I made was thinking I needed to be perfect in my saving and save as much as people told me I had to in a Roth IRA to supplement my existing retirement investment account. The best course of action was much more attainable.

Looking back, the best course of action would have been to make an initial sacrifice to open up a ROTH IRA and then contribute what I could – any amount – when I could – and let interest compound over 20-30 years between the time I learned about Roth IRA’s in my early 20’s and now. I did not do that. The reason I did not do that is because I always thought you had to save a fixed amount according to a chart or illustration I had been presented at the time.

The truth is the charts and illustrations that talk about saving $500-600 monthly in a ROTH are great but for younger people probably unrealistic. The issue is it was presented to me as very binary – either you open a ROTH and save $500-$600 a month for the next 30 years or you don’t. The truth is it isn’t binary. While it’s great to do an initial larger investment to get it going, any amount would be better than nothing and adding to it when you can would keep the machine working.

What machine might you say? The machine of compounding interest. Instead of explaining to young people how compounding interest works with a standard illustration, it may have been better to explain it as paying credit card interest – but to yourself. It’s easier to see how interest works when you have your credit card bill and realize it will take 18 years to pay your balance if you make the minimum payment than when you are looking at an investment diagram. You know the pain of the credit card bill first hand. You don’t know the pleasure of saving first hand.

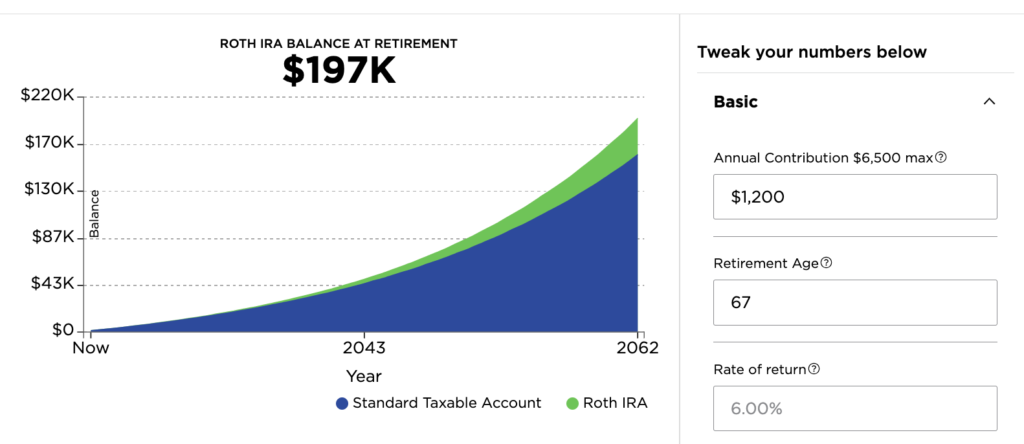

https://www.nerdwallet.com/investing/roth-ira-calculator

The pleasure of saving in ROTH doesn’t come without risk and you can lose money. But the important thing is to get an initial investment in there, add money regularly, and look at it as a 20-40 year investment, not a day-to-day investment. If I had started with $1000 and just added 100 per month over 30 years I’d have invested $49,000 and possibly ended with $197,000 over 40 years. But investments don’t stay flat – you can invest more – preferably earlier – and the power of compounding interest takes over and you end up with more. My mistake was thinking I had to investing at a certain level – we all have ups and downs. Having something started already to put a portion of a Christmas bonus, windfall, or tax refund in would have been great.

As I near the 50 years old mark I started my IRA. It will supplement another retirement investment account I have plus social security. It’s late but it’s never too late. I can make compound interest work for me for the next 10-15 years but how grand it would have been if I’d made it begin to work in my mid-to-late twenties? It would have been…grand.