Choosing the Right Life Insurance

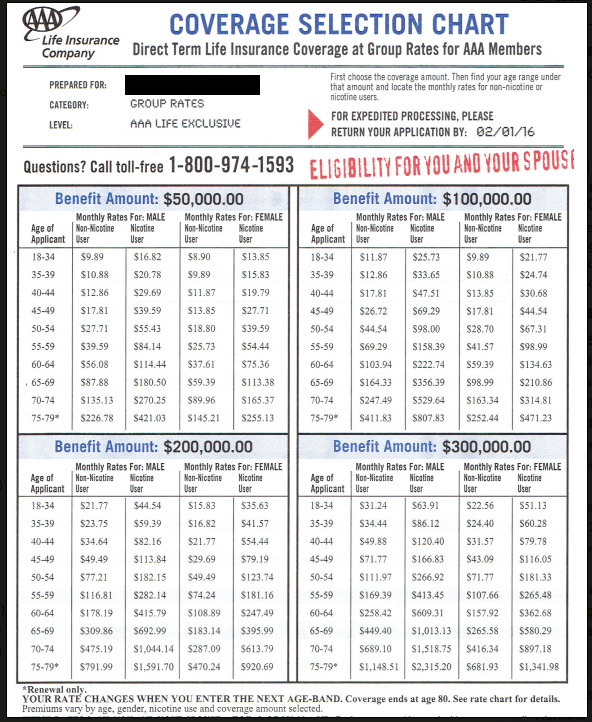

So you got a life insurance offer in the mail. I’ve gotten mailers on life insurance. I’m sure you have too. I got one for AAA (the auto club) for AAA branded life insurance. It looks good at first with their pitch of low initial premiums.

Maybe you are part of an affinity group such as a senior citizen advocacy organization or an auto club and got an offer for group term life insurance. They may offer no medical exam, exclusive group rates, or money-back guarantee for the first month. But are these policies worth it?

First it’s important to know the mail-in application is preliminary. Your answers are used to determine if coverage will be issued, it’s not an actual automatic approval. Medical records as well as consumer reporting agency records or other record keeping organizations may be obtained to determine eligibility.

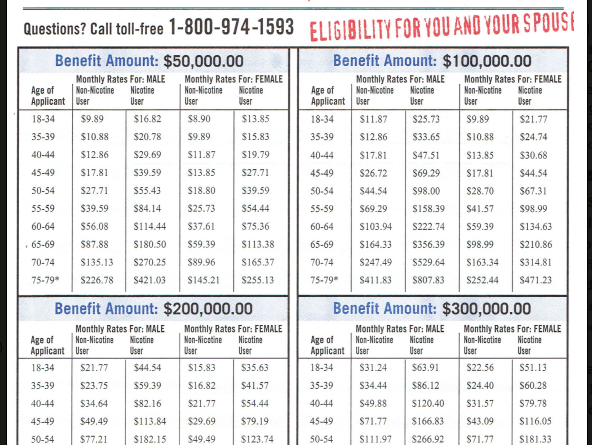

Second, it’s important to understand the rates. Some of these policies have age bands and group rates that go up in each band. It makes it harder to calculate the total cost of a policy. But it can be done, or at least estimated.

One can look at an auto club policy for a 45 year old at a certain amount and incrementally higher in 5 year increments with a disclosure that rates can go up in each band for an entire group by the time you get to that band. But if the rates stay the same, or best case scenario, you multiply the rate time 12 and by the years in the band, in this case 5. Then start adding up the bands to come up with a total for the terms offered i.e. 10 years, 20 years, etc or the time you believe you will keep the policy active.

Third, it’s important to compare the terms. Some policies offer an accelerated death benefit, some offer conversions, some have exclusions for suicide, and some offer coverage for spouses.

I looked at a regular insurance company’s rates. For this exercise I used Haven Life Insurance.

I looked at Haven’s rates if I choose ‘average’ health, $200,000 over the next 15 years. It’s approx. $13,928.40 if I got approved at that rate.

Now I look at AAA’s policies for 15 years using the age bands:

Years 1-4 $2592

Years 5-9 $5100

Years 10-14 $7680

Year 15: $2352

Total Cost: $17,724

Obliviously there are things like terms, payouts, features, etc., for instance AAA has a terminal benefit meaning if I’m diagnosed terminal I can get a payout 12 months before I’m due to meet my maker. Accelerated Death Benefit.

But this is quite a bit of math to do and I bet most people do not do it. Also with AAA the rates are NOT locked, but the rates can go up if it goes up for the entire age band and entire group at once. I’m guessing that’s a regulatory approval thing but still kind of sly.

It’s $12,319.2 for Good health under Haven. I could argue I’m good but not excellent.

But all the same it’s still Number Crunching.