Financial Power Moves for Anyone

Log into your student loan servicer to do a test payment and assess your debt are two actions everyone should do immediately. As the economic climate changes, there are some ‘power moves’ I’d recommend people make. These are everyday moves for everyday people but I consider them ‘power moves’ because most people won’t do them. The moves pertain to student loans and credit use. First let’s discuss student loans.

For years, the Federal government was making moves with student loans. The company I worked at in the 1990’s, Pennsylvania Higher Education Assistance Agency, or PHEAA, discontinued servicing Federal student loans in the 2021. Many other changes were facilitated during this time period as I got a notice my loans for my education at Penn State University were moving from Great Lakes to a company called NelNet where oddly my Penn State Loans were. It was a notice I largely dismissed since student loan payments were paused.

The contracts awarded under the USDS solicitation will replace the legacy servicing contracts for Direct Loans and federally managed Federal Family Education Loan (FFEL) Program loans to drive improved borrower outcomes, especially for vulnerable borrowers. To maintain stability as the new loan servicing environment gets underway, FSA will extend the legacy servicer contracts through December 2024, as Congress has authorized, which will help facilitate a smooth transition for borrowers.

https://thecollegeinvestor.com/34572/student-loan-servicer-changes/

Due to the pause, I recommend logging into your student loan servicer and setting up a $25 payment for your loans just to be sure the payments are set up correctly for when payments resume in a few months. The last thing you want is your first payment to a new servicer to be returned because one number in your bank account number was wrong. When that happens and it will, there will be a rush – not a bank rush] though.

There will be a rush on loan servicer call centers and websites when payments resume and payments fail. Don’t be caught in that rush. I logged into mine and did just that. Student loan payment resumption will require adjustments in personal budgets as we have lived 3 years without making payments.

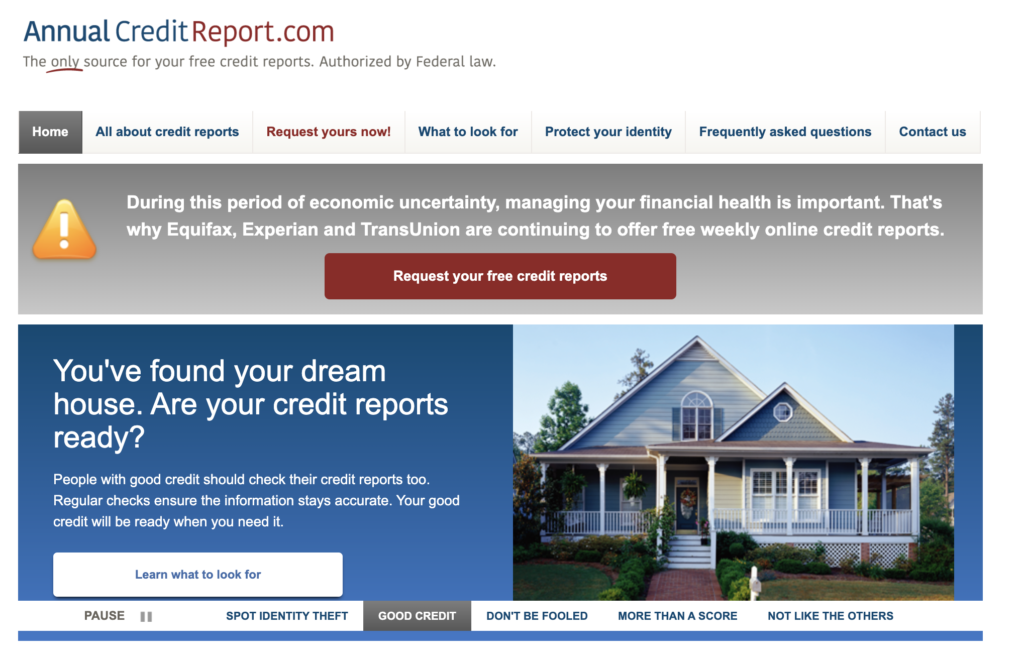

Adjusting a personal budget can be challenging. The core issue is you need to bring more money in than you send out. This can be tackled one of two ways – work more or pay less. One area I recommend looking at now is debt payments. I highly recommend pulling your credit report from all three bureaus at https://www.annualcreditreport.com/index.action and reviewing what’s on each report then make a list of the debt payments each month as they appear on your credit report.

The simple step of ‘pulling your report’ is very biblical – the truth will set you free. Once you see the truth of what you owe both in total balances and monthly payments you can begin to tackle it. For anything in collections I recommend calling the collector and settling the debt for a reduced amount. For anything not-in-collections I recommend paying off the smallest debt first and then apply that payment in the future to the next debt, and the next debt until you are out of debt. This will lead to an amazing place.

This will eventually generate extra revenue you can use to pay your student loan and begin to save. Once you see how much is going to debt each month and dream what you could be using that amount for, then you can dream big and picture a life where you are debt free and can live and give like no one else – or at the least be prepared for any economic downturn to come.

In the end we know tough economic times are on the way. These are just a few tips you can use to get ready and not be caught by surprise in the times to come.