Stepping Out on Your Own: The Journey Begins

Striking out on your own can be challenging – whether you work full time and just got a side gig or are going all in on a new business – but I have some advisements. Striking out on your own can look different from journey to journey. No matter what path you take, there are things you should look at differently from what it looks like, how to treat money that comes your way, to preparing for the future for yourself and your journey. This is a journey taken by many but rarely is it a straight line like regular employment is. This journey has peaks and valleys.

“That freelance writing business is a good example of my naturally cautious style: I wrote on nights and weekends while working a full-time job for nearly three years before I felt comfortable quitting and taking my freelance writing business full time. I had to get used to a variable income, as many of us writers have lately. I experienced about a 40% drop in writing income between March 2020 and April 2020, which is a lot to absorb in a budget. It’s easier, though, because I’ve gotten in the habit of saving a portion of my income every single month; that portion of the loss is much easier to stomach, since it wasn’t already allocated to a bill or a purchase.”

(Maria, Laura. May 2020. The Financial Diet).

The peaks and valleys can be difficult but they don’t have to be. What follows are advisements from my 15 year journey. They are not mandates, tax advice, or legal advice. They are largely from my journey of being self-employed from 2009 to owning my own Limited Liability Company in 2015. I only offer it as advisement and a share of my experience. Anyone considering stepping out on their own should consult an attorney, CPA, Investment advisor and other professionals before taking any of the same steps I did as I struck out on my own – which by definition can look different from journey to journey.

Striking out on your own could take a variety of appearances. For some it may look like coaching at the local gym. For others it may be a short term or long term consulting engagement. It could be starting your own tech company. Getting paid to write a book, blog, or series of articles definitely qualifies. Driving for a ride share, doing small tasks as a handyman, and nearly anything in the gig economy also counts. Anything that you get a 1099 form and not a W2 form qualifies as striking out on your own as well. Once you get a 1099 and not a W2 you are self employed as far as most measures go which means you are your own employer. The 1099 becomes a new lens to look at things differently.

Top 21 Independent Contractor 1099 jobs (Keepertax.com)

- 1. Photographer

- 2. Website designer

- 3. Virtual assistant

- 4. Bookkeeper

- 5. Delivery jobs

- 6. Landscaper

- 7. Online writer

- 8. House cleaner

- 9. Dog walker

- 10. Amazon reseller

- 11. Flipper

- 12. Editor

- 13. Blogger

- 14. Tutor 15. Online teacher

- 16. Transcriptionist

- 17. Life coach

- 18. Realtor

- 19. Research study participant

- 20. Graphic designer

- 21. Social media marketer

(Nelson, R., CPA. Keepertax, 2023, August 18).

The first thing I recommend to look at differently is your expenses. I track everything. Keep receipts, keep a log of miles, gas pump receipts, meal receipts with details of who – what – where – when – and why, as well as purchases relating to anything used to generate revenue. You no longer generate income, you generate revenue. Revenue is everything you bring in, income you can think of as your take home pay, or put another way, revenue minus expenses. Consult a tax expert for a list of expenses to track.

“Revenue is the total amount of money an entity earns from a variety of sources. Income, on the other hand, is the total amount of money earned after all expenses are deducted.”

(Boyte-White, Investopedia, December 2023)

Next you want to look at your revenue in terms of taxes. I suggest you set up a two business accounts, one for revenue and expenses, the other for tax withholding for year one. Any time you get a check, an advance, a deposit, or other revenue for your work, contract, book, or other project transfer an amount into the second checking account for taxes. You are no longer an employee so you no longer have deductions made before you receive your check. I recommend multiplying every check total by .153 to put 15.30% away for taxes for the first year to prepare for tax season.

At tax season the following year you will have a pile of money to pay your taxes with and less of a surprise. Your employer does this for you but you are your own employer so now it’s your job to set aside social security, Medicare, state, and federal taxes. Once you have a year’s worth of data, you can estimate your quarterly taxes and make quarterly payments to the Internal Revenue Service so tax time is – forgive the pun – less taxing (stressful). This is a short term version of savings but you have to consider long term savings as well.

“As a participant in the gig economy, you’re an independent contractor in the eyes of the IRS. Essentially, you’re a solo entrepreneur, which ushers in a unique set of tax rules and obligations. Central to these obligations is the Form 1099 series (Form 1099-NEC, Form 1099-K, Form 1099-MISC).”

(Internal Revenue Service, 2024)

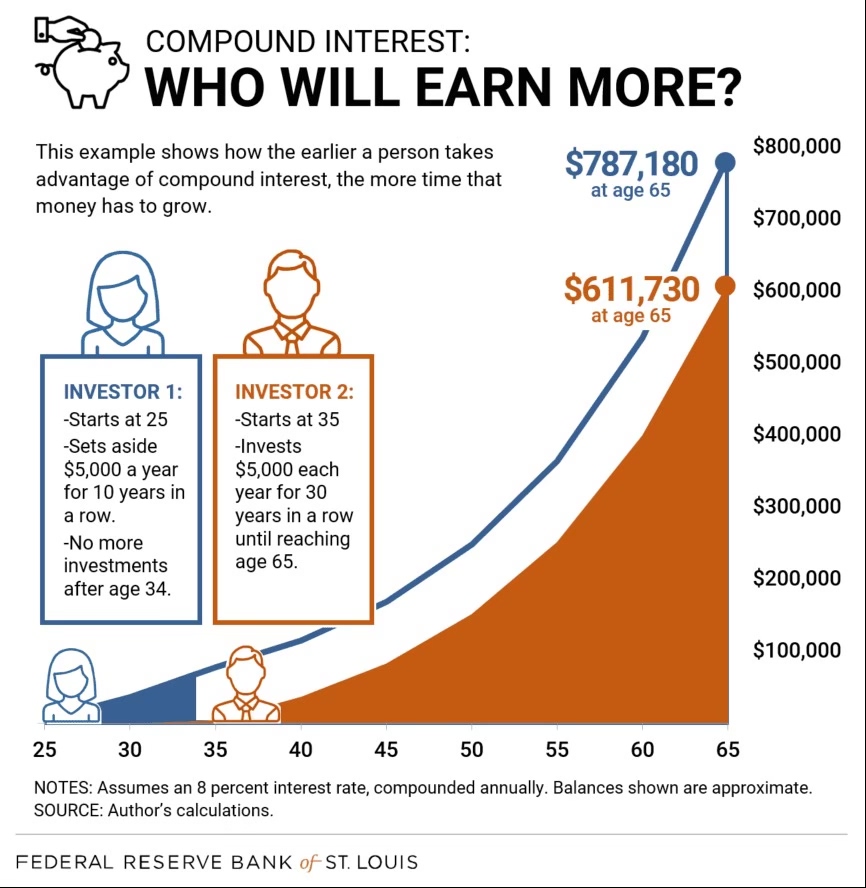

Long term investing is a must. There is no employer 401k, pension, or other savings vehicle. There is no pre-tax transportation or employee meal program that saves you money in a tax advantaged way. It’s all on you now. Whether it’s a mutual fund, ROTH IRA, SEP IRA, or other investment vehicle, it’s important to start immediately not from a financial return standpoint but from a habit starting position – time passes quickly.

Retirement age comes faster than you will realize and you will be thankful you set a bit aside early. It’s important to note that Investments come with risk. I did not bring up savings accounts here because though they are generally guaranteed, they do not grow very big – neither do savings bonds. Starting early means you can endure the ups-and-downs of the financial markets which can be fueled by wars, politics, and other market related pressures. Ups and downs over 15-30 years give your investments time to go up and down as there will be good days and bad days. Starting early is paramount.

(Mark, & Catanzaro, M. C. (2018, September 12). How Does Compound Interest Work? Federal Reserve Bank of St. Louis. )

Good days and bad days can also describe revenue seasons. If you are an actor, you are considered self-employed and maybe only get a check for a role you play 3-6 months of the year; From that check you need to set aside enough for the entire year as another role may not come until the following year and many auditions. If you are writing a book that one big advance has to last until the next book or until your cut of the sales exceed the advance in many cases. This will also help you make better decisions.

Having savings can create margin and when you have margin you make different decisions about business. You may not take a difficult client because you need the cash, be forced to offer a discount because you need the cash, or devalue yourself because you need the cash if you have funds to keep you good until the next good gig comes along. If you are a consultant you may find that January-May are good for you but June-November isn’t a good season due to business budgets being re-forecasted in mid-year months like June or July – or you may find the summer is good for businesses who’s fiscal years run July 1 to June 30 each year. Bad days are not just low revenue days.

“Fiscal year (FY), in finance and government, an annual accounting period for which an institution’s financial statements are prepared. Different countries and companies use different fiscal years (often referred to in financial records with the acronym FY), and the fiscal year need not align with the calendar year. While countries generally have a default fiscal year used by the government, they often allow individuals and organizations to employ different fiscal years based on their specific needs.”

(Edridge, Britanicca Mony, 2024)

Bad days can also include the unexpected and for the unexpected there’s a single word to sum up your needs: insurance. As an employee you may have had an employer based life insurance policy, you employer may have provided health insurance, unemployment insurance, workers compensation insurance, and you may have been covered by your employers liability insurance should you have done something on the job that required coverage. You are now your own employer.

It’s now on you as your own employer to have the proper coverage in place. In some cases if you are married you may be able to get health insurance through a spouse’s employer, in others you may be on your own. Some insurance may be required during your journey by state or federal regulations while others is simply good planning such as life insurance. Consult an independent insurance agent to review your insurance needs. Do this consultation early on in your journey.

“An independent agent is an insurance agent that sells insurance policies provided by several different insurance carriers, rather than just a single insurance company.”

(Touvila, Investopedia, June 2023)

At some point, it will be time to look at what your journey looks like. Some people do this as the first step, some do it after a period of time. What is this look? This is called business formation. When you start many people are sole proprietors which means you do business as yourself. Others join forces with another person and become partnerships. You may decide you need to be a company in which case you have choices that include but are not limited to Limited Liability Companies and corporations.

“The business structure you choose influences everything from day-to-day operations, to taxes and how much of your personal assets are at risk. You should choose a business structure that gives you the right balance of legal protections and benefits.”

(United States Small Business Administration)

My last piece of advisement is to get together with others who are in similar situations on a regular basis. You may go the daily grind alone especially if you are a consultant, private investigator, book writer, coach, or have chosen a similar journey. Your clients are not your social circle. The workplace was a social support mechanism, social circle, and social environment. Leads and business networking groups are great for business but you do have social needs – so be sure to get together with others whether it’s lunch, coffee, a gym session, a shopping trip, or simply a walk. This is not a business meeting.

I advise not to include many people you do business with and refrain from the suggestion of doing business with this group of people. Removing the expectation of a deal being presented or closed – or worse – the expectation of a deal at a discount because you are friends – removes the pressure and lets everyone be both honest and comfortable. It’s more of a guideline than a rule.

From time to time I do lunches with people I do business with – but you don’t want your entire circle to be transactional. I define a transactional relationship as a relationship based on doing business – because that can create more stress than you are trying to alleviate. You want to have a good social circle and having one where business is conducted can keep people from being honest for fear of impacting the deal or how business is conducted.

“On top of all that, being a freelancer can get really lonely if you don’t emphasize being around people you enjoy. You don’t have cubicle neighbors. You don’t have your work buddy right down the hall. And other than talking to clients and finding work, you don’t have anything forcing you to interact with other people.”

(Riker, 2017. Freelancers Union Blog)

What I’ve presented here is not all-inclusive. It’s a starting point of nuggets I’ve learned over the last 15 years of being self employed – some the easy way, most the hard way. As I said many times, consult an expert such as a tax advisor, CPA, attorney, or other subject matter expert. Nothing in this article represents tax advice. If you want more of a mental health take, check out my article “Becoming Your Own Boss, Give Yourself Permission”. Bringing in money other than your regular job can be exciting – and your future is in your hands now.

Remember, you got this! Let me know how you make out on your journey, drop me a line at ron@ronhall.org and all the best!

Required Disclaimer: Ron Hall does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Good Reads

- The Long-Term Spending Strategy That Helps Me Stay Self-Employed Through Dry Periods

- Top 21 Independent Contractor 1099 jobs

- An Introduction to Tax Forms for Gig Economy Workers. Internal Revenue Service

- Revenue vs. income: What’s the difference?

- Fiscal Year (Britannica)

- Choose a Business Structure

- Independent agent: What it is and what they do

- How to create a social circle as a freelancer

- How Does Compound Interest Work?

Works Cited

Marie, L. (n.d.). The Long-Term Spending Strategy That Helps Me Stay Self-Employed Through Dry Periods. The Financial Diet. https://thefinancialdiet.com/the-long-term-spending-strategy-that-helps-me-stay-self-employed-through-dry-periods/

Nelson, R., CPA. (2023, August 18). Top 21 Independent Contractor 1099 jobs. https://www.keepertax.com/posts/independent-contractor-jobs

Boyte-White, C. (n.d.). Revenue vs. income: What’s the difference? Investopedia. https://www.investopedia.com/ask/answers/122214/what-difference-between-revenue-and-income.asp

An Introduction to Tax Forms for Gig Economy Workers. Internal Revenue Service. February

2024. Retrieved from: https://www.taxpayeradvocate.irs.gov/news/nta-blog/an-introduction-to-tax-forms-for-gig-economy-workers/2024/02/

Mark, & Catanzaro, M. C. (2018, September 12). How Does Compound Interest Work? Federal Reserve Bank of St. Louis. Retrieved February 22, 2024, from https://www.stlouisfed.org/open-vault/2018/september/how-compound-interest-works

Encyclopædia Britannica, inc. (n.d.). Encyclopædia Britannica. https://www.britannica.com/money/fiscal-year

Choose a business structure. U.S. Small Business Administration. (n.d.). https://www.sba.gov/business-guide/launch-your-business/choose-business-structure

Tuovila, A. (2023, June 19). Independent agent: What it is and what they do. Investopedia. https://www.investopedia.com/terms/i/independent-agent.asp

Riker, R. (2017, October 6). How to create a social circle as a freelancer. Freelancers Union Blog. https://blog.freelancersunion.org/2017/10/03/how-to-create-a-social-circle-as-a-freelancer/